What is the EU Corporate Sustainability Reporting Directive (CSRD)?

*The EU Omnibus proposal is out, which suggests some changes to this regulation/s – though these aren’t confirmed.

The Corporate Sustainability Reporting Directive (CSRD) is an important European law. It aims to enhance transparency and accountability on environmental, social and governance (ESG) issues, by requiring businesses to include related information in their corporate reporting. Learn what companies it applies to and what these businesses must do.

The CSRD is a business reporting law. It requires certain companies to publish sustainability-related information every year, as part of their annual accounts and financial statements.

The CSRD is partly about standardising corporate sustainability information and non-financial reporting – to help investors, civil society organisations, consumers and others to understand and compare companies’ sustainability performance. This includes evaluating financial risks and possible benefits linked to this, and understanding the impacts of companies’ actions on society and the environment.

Who does the CSRD apply to?

Different thresholds for different companies

The CSRD applies to large companies in the EU, smaller companies listed on EU stock exchanges and non-EU companies with a large EU branch.

- The lowest threshold is for EU and non-EU companies with “listed securities” (publicly traded assets such as bonds or stocks) on EU financial markets, including stock exchanges. They must also meet two of three criteria:

- +€900,000 annual net turnover

- +€450,000 in total assets

- +10 employees on average across the year

- The next threshold is for non-EU companies with activities in the EU. The CSRD’s scope covers these companies generating more than €150 million annual net turnover in the EU and meeting any of these additional criteria:

- An EU branch with annual net turnover of +€40 million

- With a subsidiary considered a “large undertaking” in the EU

- With a subsidiary listed on an EU stock exchange

- For companies in the EU, they are in scope if they meet any two of these thresholds:

- Annual net turnover of +€50 million

- Assets/balance sheet of €25 million

- +250 employees on average across the year

Not sure if your company is in scope? Contact our Consulting team to learn more.

When are reports required?

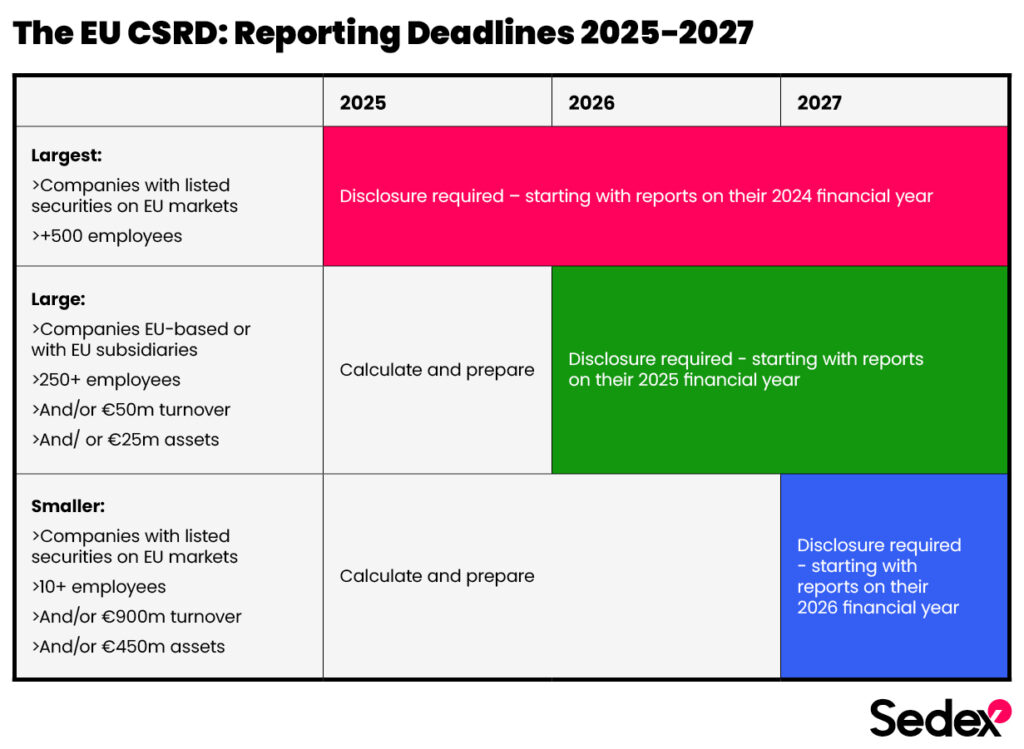

The CSRD’s scope will expand over a few years between 2025-2029.

The first companies in scope are the largest ones. They have to provide their first reports in 2025, based on their 2024 financial years.

What do companies need to do?

Conduct a double materiality assessment

This is a fundamental part of the CSRD. Companies must complete a double materiality assessment to highlight the sustainability issues that are considered material (most relevant and significant) for their business.

The “double” part means looking both at how ESG issues could affect a business (its financial success and its ability to operate) and how the business’s activities could affect people and the environment. Companies should consider all of their value chain in these materiality assessments – including their upstream supply chain, how their products or services are used, and product lifecycles.

Supply chain data and risk assessment insights may be useful for helping to understand whether particular risks are material, depending on the proportion of a supply chain where a risk is considered high.

Report on their business and material sustainability issues

Companies must report their information, conclusions, actions and progress in a specific way outlined in the European Sustainability Reporting Standards (ESRS), developed by European Financial Reporting Advisory Group (EFRAG). This regulation outlines disclosure requirements for general company information, along with 10 ESG topic areas for consideration. Companies identify which topic areas are relevant through their double materiality assessments.

Other activities that companies need to report on are in relation to those material topics. These activities include:

- The relevant company policies

- How the company assesses the related risks, impacts and opportunities

- Their conclusions and related actions or programme to address the issue

- Their progress and outcomes

Prepare a transition plan

Companies need to outline how their strategies contribute to reducing greenhouse gas emissions in line with the global targets of the Paris Agreement, particularly the aim to limit global warming to below 2° Celsius, preferably to 1.5°C.

The transition plan should reflect a company’s commitment and approach to sustainability. It should detail the company’s targets for reducing emissions and how it will adapt its business model in response to climate-related issues.

The plan should also include a roadmap for achieving the targets outlined, demonstrating the measures the company will take to mitigate risks and capitalise on opportunities related to sustainability concerns. This includes addressing both operational changes and supply chain considerations to ensure comprehensive sustainability practices.

Get reports independently verified

Companies have to get their CSRD reports independently verified, referred to as “assurance”, by a certified professional such as a financial auditor.

Support CSRD compliance with Sedex

Companies need to describe their supply chains in their CSRD reports, as part of outlining their business model and value chain.

Depending on the conclusions of their materiality assessments, companies may also need to include their supply chain in the policies and activities they report on. Sedex’s solutions enable essential underlying supply chain-related activities, analysis and data.

Leverage supply chain data in materiality assessments

Companies can use data on suppliers’ locations, industries and processes in double materiality assessments – for example, to help identify the proportion of supplier sites in high-risk countries or industries for different ESG issues.

Connect with suppliers on our Sedex Platform to access their existing data, and gather more information about their sites through our Self-Assessment Questionnaires.

After double materiality assessments

A double materiality assessment might conclude that a company’s value chain, including its supply chain, is relevant for one or more material ESG issues.

Sedex’s solutions are particularly essential if materiality assessments indicate a company should report on ESRS topic S2 – “Workers in the value chain”.

- Design action plans to implement supply chain sustainability goals with our Consulting team

- Map a supply chain, analyse supplier data and carry out risk assessments through the Sedex Platform, to identify the parts of a supply chain most relevant to material ESG issues.

- Identify sustainability risks, management processes and opportunities for improvement through Self-Assessment Questionnaires and the in-person SMETA audit.

- Use supplier data and Sedex Platform insights to help shape the supply chain aspects of sustainability policies, targets and improvement activities.

In CSRD reports

Companies can use their Sedex Platform data to help outline their supply chain, as part of the CSRD’s requirements to describe the business model and value chain.

Where companies include their supply chains in relation to material sustainability issues, they can also refer to their Sedex assessment activities, supplier data and insights in reporting. For example:

- Using supplier information, risk assessment results, reporting dashboards and Sedex Platform insights to outline what parts of a supply chain are included in relation to material sustainability issues.

- As examples of activities carried out to identify, understand, prevent and address the risks, actual impacts and opportunities in a supply chain related to the material sustainability issues.

- Using results such as closing SMETA non-compliances to demonstrate driving improvements in sustainability practices and risk management in their supply chain.

Be sure to check out our latest blog on the EU Omnibus proposal for a detailed summary.

Talk to us about improving your supply chain sustainability compliance and reporting.