How to Set and Achieve ESG Goals

Companies worldwide face increased pressure from investors to set, track and meet ambitious goals in environmental, social and governance (ESG) areas. Doing so requires both higher quality and quantity of ESG data.

- US companies with the best ESG scores had 8% higher returns in 2021.[1]

- 86% of investors are dissatisfied with environmental risk information disclosed by businesses.[2]

- More and more legislation on corporate sustainability reporting is being passed worldwide, including in Europe and the US.

These are all indicators of the growing need for businesses to focus on ESG as a result of pressures from consumers, investors and governments.

How can companies respond to this demand? And where should they start? Here are our recommendations for getting started with effective ESG goals in your business.

- Identify priority areas of sustainability

The first step is to determine the areas of ESG to report on first. A company’s priorities will vary depending on its industry, markets and operations (among other things).

We recommend starting with the “low-hanging fruit” – topics that you already have a lot of data on, e.g., waste or resource use. You may already have data on other issues, particularly if your business is within the scope of specific regulations – such as emissions reporting or modern slavery laws.

Set goals in areas where you are already collecting data, and build your strategy around these topics.

Next, we recommend choosing topics close to your business values and mission, e.g., food poverty or green energy. You should also check for legislation and regulations within the countries and areas you operate and sell within.

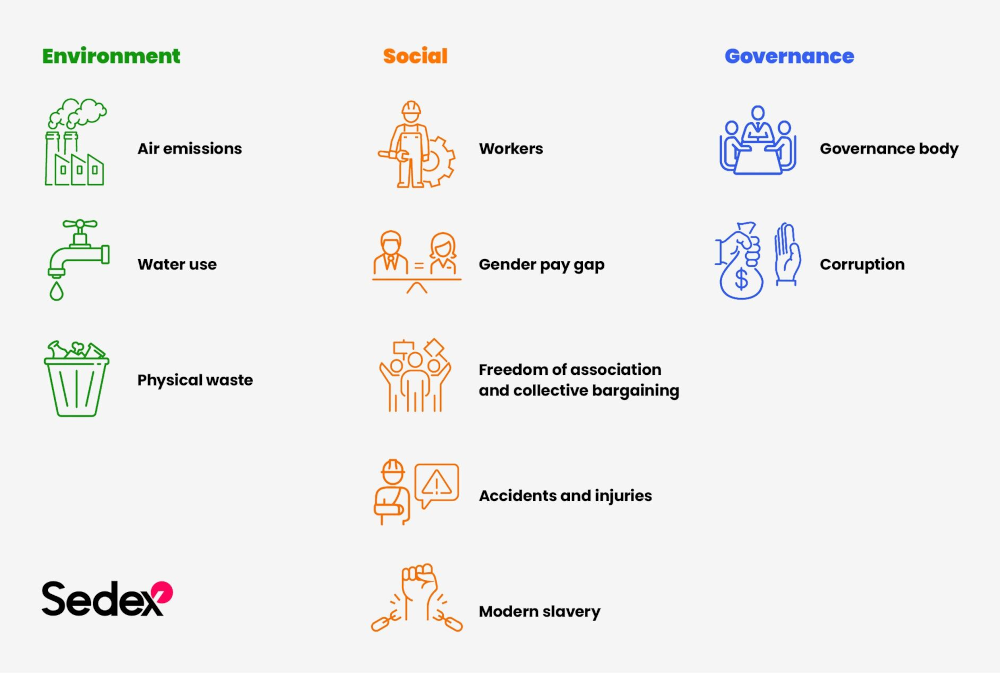

Top ESG topics include:

2. Setting ESG targets and goals

After deciding what ESG topics to focus on, the next step is to set your goals and targets for these.

- Set a baseline measurement. Work out what you’re currently doing across the business. Bring in different departments and look at the gaps between your current activities, information and processes, and the data you’re likely to need based on your priority ESG areas. These baselines are what you’ll measure progress and ESG targets against.

- Understand your current data. Using the baseline and gap assessment, you should be able to understand what you are currently measuring and also what you should be measuring. From there, you can determine your initial ESG strategy. Set realistic targets and the key performance indicators (KPIs) and metrics you’ll use to measure progress.

- Work collaboratively. Working across different departments collaboratively within your organisation is critical. Agree on the focus areas and KPIs to facilitate the free flow of data from various departments into your central reporting function.

- Set tangible, specific targets. With increasing scrutiny on companies’ sustainability claims, greenwashing and corporate transparency, it’s crucial to be specific about the targets you set. Avoid language like “becoming a greener company” – opt for specific targets where you can easily report on and evidence progress through data.

3. Collecting your ESG data

There are many ways to collect ESG data. Which methods you use can depend on which topics you focus on and the set-up of your organisation. Methods include:

Cross-departmental performance tracking and information collection, e.g.:

- Ensuring water metre readings are regular, accurate and recorded.

- Setting procedures for logging accidents in the workplace and reviewing these quarterly.

- Maintaining up-to-date records of employee training on sustainability topics.

Using third parties to support information collection, e.g.:

- Using your energy company to get data on green energy percentages.

- Partnering with a supply chain management company to collect data through audits and assessments.

4. Communicating your targets, data and progress to stakeholders

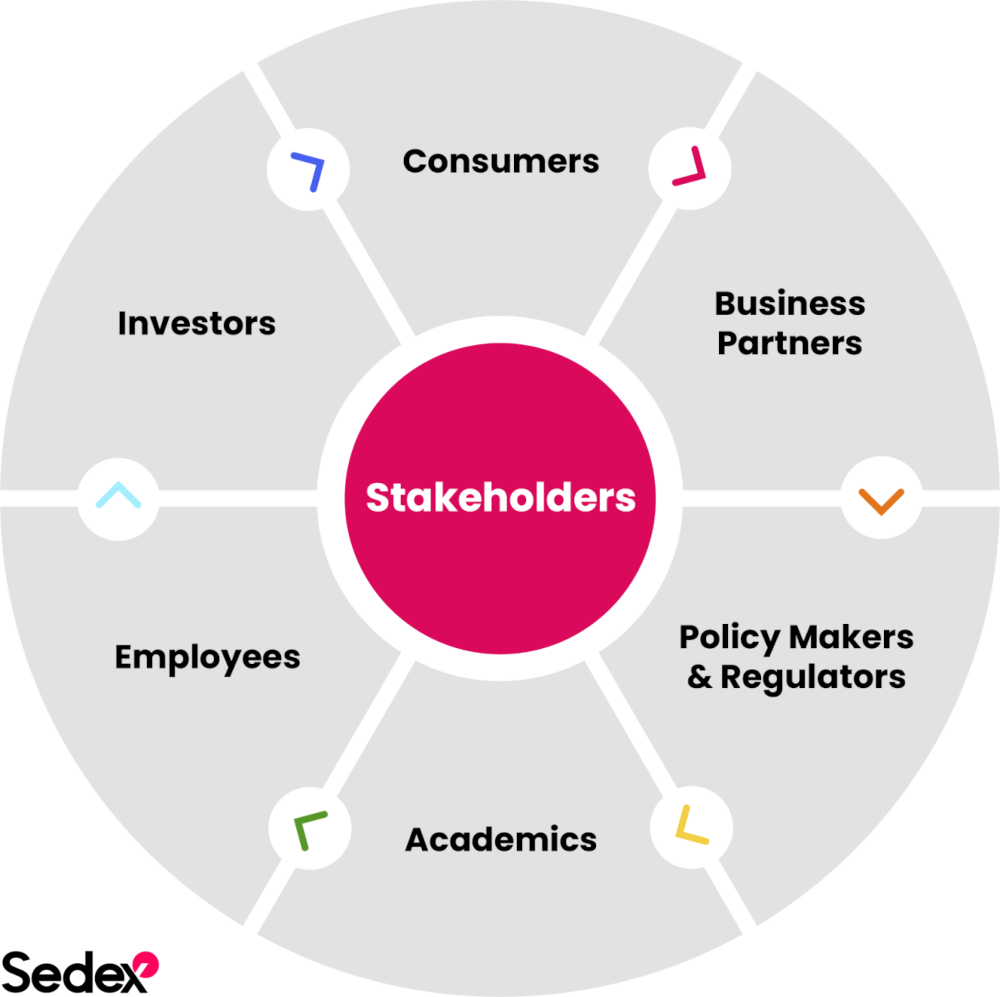

When you are ready to communicate progress towards your ESG goals, it’s critical to consider your stakeholders. What do they want to see from your ESG strategy and data?

Tailor your metrics and how you frame them when sharing with specific stakeholders. For example, when sharing ESG progress with consumers, you’ll want to ensure the information you share is easy to navigate and understand.

We are seeing more regulators and investors requiring standardised ESG data and reporting.

Best practices for ESG reporting

- Keep it clear, consistent and clean. Keep your messaging clear, be consistent with the scope of the data you report on and ensure that reporting cleanly aligns with your ESG targets.

- Start early. Don’t wait until the last minute to respond to requirements or obligations from internal or external stakeholders. Reassure them by responding promptly.

- Get leadership buy-in. Find an executive or senior sponsor to invest in your ESG strategy early on, to help get all the resources you need.

- Stay updated on changing requirements. Regulation is constantly evolving — it’s crucial to keep up-to-date with the latest requirements.

- Link performance to core business goals. Progress faster and achieve your targets by linking ESG goals to company financial performance.

How Sedex can help

Our data Platform, tools and services provide a seamless solution for holistic ESG management and reporting.

- Self-Assessment Questionnaire (SAQ): Gather social sustainability information about a worksite’s activities, working conditions and people. This data lives in the Sedex Platform for integrated analysis and reporting. Complete for your facilities and ask suppliers to complete one for each of theirs.

- Risk assessment: Our risk assessment tool enables human rights and environmental risk analysis across your operations and supply chain. Study inherent risks in relevant countries and sectors and build custom risk profiles for every worksite.

- SMETA Audit: Our supply chain audit builds a comprehensive picture of a worksite’s operations, people and working conditions through an in-person assessment. Use it to look at your own or suppliers’ facilities.

- Sedex Platform: Data captured through an SAQ and site assessments can be stored on our integrated data platform, feeding into other Sedex tools to support ESG risk assessment and reporting.

- Consulting: If you’re unsure where to start, or want to accelerate your ESG strategy, our Consulting team can help you develop a plan for the ESG goals most relevant to your business.

Want to learn more on this topic? Watch our on-demand webinar.

For support with ESG goals, get in touch with our experts.

Sources:

EY, How to enhance long-term business value through sustainability: https://www.ey.com/en_vn/sustainability/how-to-enhance-long-term-business-value-through-sustainability

Morning Star, Why Sustainable Strategies Outperformed in 2021: https://www.morningstar.com/articles/1075190/why-sustainable-strategies-outperformed-in-2021