The Cocoa Challenge: Turning High-Risk Supply Chains into Resilient Ones

Cocoa remains a critical global commodity at the heart of both economic opportunity and sustainability risk. Around 70% of the world’s cocoa is produced in Africa (mainly West), where persistent challenges – child and forced labour, poverty, land degradation, and ongoing deforestation -continue to undermine sector resilience.

At the same time, tightening regulation, including the EU Deforestation Regulation and CSDDD, is raising the bar for cocoa due diligence, forcing companies to prove that their sourcing is responsible, transparent, and compliant.

This article builds on our broader analysis of Food & Beverage supply chain risk and uses insights from Sedex’s vast dataset on cocoa supply chains (including self-assessment questionnaires and SMETA audits) to provide sector-specific guidance on addressing cocoa supply chain risk and advancing ethical cocoa sourcing.

Why Cocoa Supply Chains Remain High Risk

Cocoa is widely regarded as a high-risk agricultural commodity, shaped by complex, multi-tier systems where smallholder farmers dominate production. Most cocoa is grown on plots under five hectares, often sold through informal intermediaries that make supply chain transparency in cocoa difficult to achieve.

Limited infrastructure and the prevalence of family labour create conditions where child labour in cocoa remains widespread, particularly during peak seasons. Economic pressure (including low farm-gate prices and unstable incomes) drives excessive working hours, hazardous tasks, and in some cases land encroachment, increasing overall cocoa supply chain risk.

Environmental pressures intensify this vulnerability. High rates of deforestation, soil depletion, and climate-driven yield stress pose significant threats to cocoa farming sustainability, prompting regulators to tighten deforestation regulation globally. Yet governance systems in producing countries often lack the capacity to enforce standards consistently, increasing the burden on companies to conduct robust human rights due diligence and environmental assessments, often verified through tools like the Sedex SAQ and SMETA audit.

Layered onto this are reputational sensitivities: chocolate brands face intense NGO and consumer scrutiny, with expectations for ethical cocoa sourcing, traceability, and verifiable impact continuing to rise. In this context, advancing cocoa sustainability requires not only compliance but proactive, data-driven transformation across the entire supply chain.

What Sedex Data Shows: Key Risks and Non-Compliances

Sedex’s vast database of self-assessment questionnaires (SAQs) and SMETA audit data, make Sedex uniquely positioned to highlight the key risks and emerging trends across the cocoa supply chain down to site level.

In the past 10 years there has been a 200% increase in the number of cocoa sites on the Sedex platform, including sites growing cocoa, processing cocoa beans, and manufacturing cocoa and confectionary products. These sites now account for approximately 280,000 workers globally.

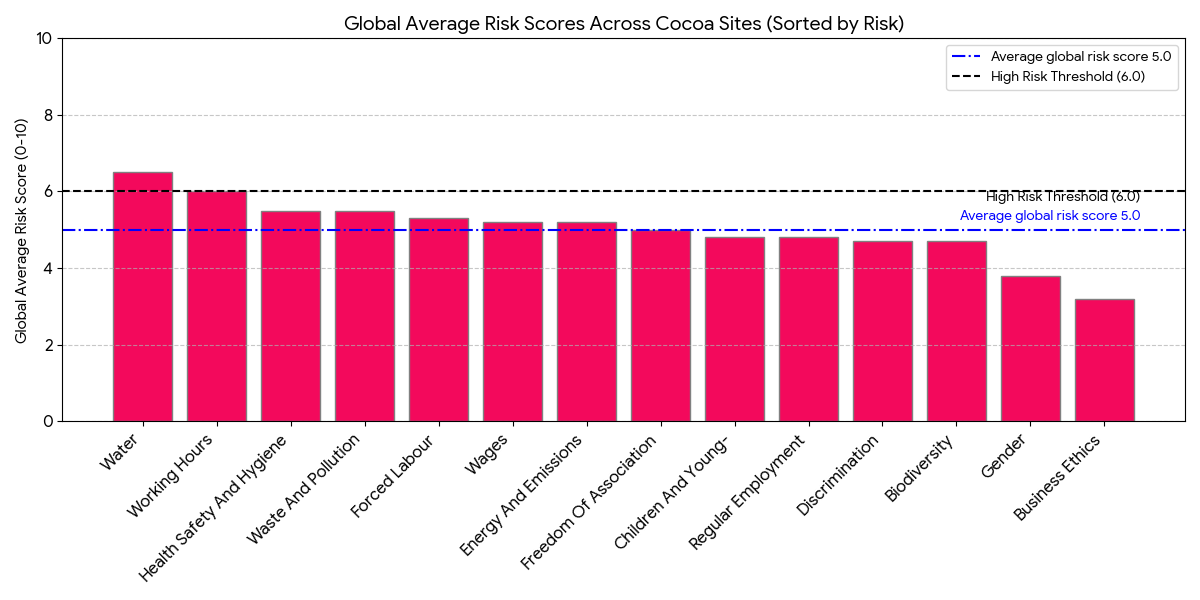

While the average combined risk score across these sites is medium (5 out of 10, as shown by the blue line in the graph below), according to SAQ and SMETA data, a deeper look tells a more complex story. The graph below shows that across the 14 indicators Sedex bases risk on, working hours and water stand out as high-risk indicators across cocoa operations globally, underscoring the economic and environmental strains that are shaping the industry.

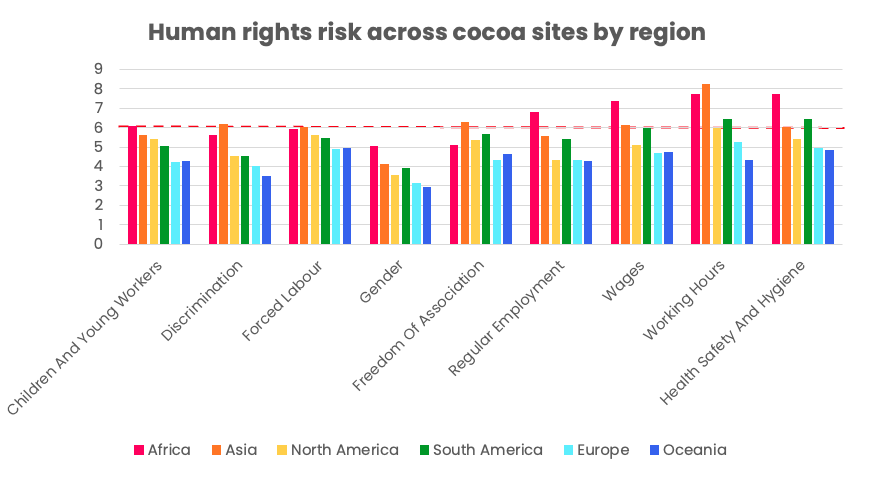

We can then look deeper into regional differences, where we see that average combined risk across cocoa sites in Africa is 20.5% higher than the global average (and high-risk), whilst all other regions score medium risk on average.

However, a closer look at individual indicators reveals important regional nuances that paint a more accurate picture of risk. In the graph below, which shows labour-indicator risk by region, wages, working hours, and health & safety emerge as the three highest social risks, scoring high across both Africa and Asia. In particular, working hours in Asia represent the highest risk overall – 7.8% higher than the average observed across Africa (across cocoa sites).

If we drill down into audit data across cocoa sites more specifically – we see similar trends.

77%

of audit non-compliances at cocoa sites are linked to wages, working hours and H&S (in the last 12 months)

58%

of critical and business critical audit non-compliances at cocoa sites are linked to H&S (in the last 12 months)

Since 2020 there’s been a 174% increase in the number of audits across cocoa sites per year, a large portion of which have been driven by a rise of manufacturing sites (cocoa, chocolate, and sugar confectionary) in China and the United States. These two countries make up 21.4% of all non-compliances across cocoa sites globally in the last 12 months (split evenly), followed by Turkey and Mexico.

If we look at global cocoa production however, Côte d’Ivoire and Ghana dominate global figures, jointly supplying nearly 60% of the world’s cocoa. While Côte d’Ivoire produces roughly twice as much cocoa as Ghana, farmers in both countries earn low incomes, often below the poverty line, and face pressures such as child labour, disease outbreaks like swollen shoot virus, illegal mining, and climate-related shocks including El Niño-driven drought.

If we look at the Sedex data, we see that both Côte d’Ivoire and Ghana have a high inherent risk across regular employment, wages, and H&S, all of which are closely linked to the ILO’s indicators of forced labour. Using these indicators in practice can help teams quickly flag patterns (such as excessive overtime or unclear employment terms) that may warrant closer investigation or targeted mitigation efforts on the ground.

However, the two countries diverge in risk when it comes to working hours – with Côte d’Ivoire displaying extreme high risk, whilst Ghana has a 36% lower inherent risk around working hours (medium risk). This may reflect broader structural or economic differences between the two countries’ cocoa sectors, such as variations in farm organisation, labour availability, or production pressures, which could contribute to longer working hours in Côte d’Ivoire.

Alongside social risks, environmental factors play a key role in cocoa supply chains, influencing how farms operate and presenting opportunities for more sustainable and resilient practices. Environmental non-compliances are the 4th most common non-compliance type across cocoa sites in the last 12 months (after wages, working hours and H&S), with the most common non-compliance sub-category being general environmental permits and management systems.

This is also evident when we look at non-compliances linked to water (waste and usage) and land use (reforestation, conservation and biodiversity):

11%

of non-compliances across cocoa sites are linked to water waste and usage, with the most common non-compliance linked to insufficient wastewater disposal permits as per legal requirements.

7%

of non-compliances across cocoa sites are linked to reforestation, conservation and biodiversity, with the most common non-compliance linked to a lack awareness of local laws and regulations covering biodiversity.

Robust environmental management systems not only help prevent non-compliances but also create the structure needed to monitor, report, and continually improve a site’s performance -an especially important factor in cocoa supply chains, where many of the most common non-compliances stem from gaps in basic documentation, permits, and oversight.

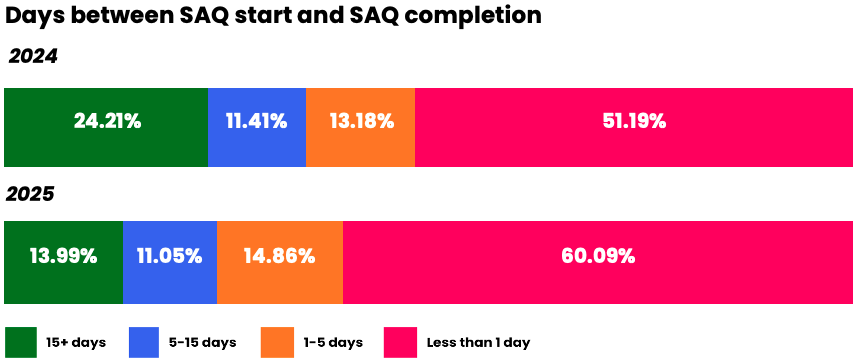

Self-assessment questionnaires (an effective early warning system for site-level issues) can be used to assess a site’s management systems prior to conducting an audit. Between 2024 and 2025, the average time taken across all sites globally to complete SAQs has fallen, with over 60% of sites in 2025 completing a SAQ in less than a day, highlighting both increased familiarity with the process and the potential for faster identification of emerging risks.

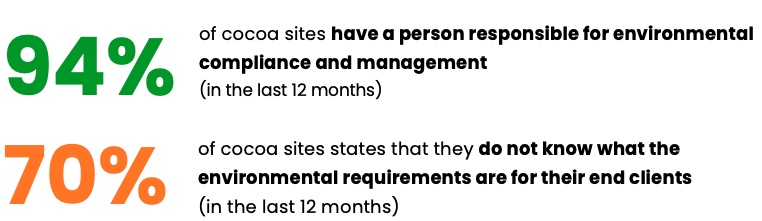

Analysis of SAQ responses from cocoa sites specifically over the past 12 months shows that most sites have a designated person responsible for environmental compliance and management, which supports stronger oversight of environmental risks. However, a significant proportion are unaware of environmental requirements from their end clients, highlighting gaps that could lead to non-compliance or misaligned practices.

While most sites report no negative impact on the rights, lands, resources, territories, livelihoods, or food security of indigenous peoples or local communities, SAQ responses from the last 12 months show that 15 % either have had an impact or cannot confirm due to not having conducted an assessment, signaling a need for more proactive risk evaluation to prevent potential social and reputational harm.

By combining detailed audit and SAQ insights across a wide range of sites and industries, Sedex data becomes a particularly powerful tool for spotting patterns and addressing systemic risks in cocoa supply chains before they escalate. This depth and breadth of information allows companies to move beyond individual non-compliances and take a more strategic, proactive approach to risk management.

If you’re a member and are looking to learn more about risks and opportunities in the cocoa supply chain, reach out to our Data Intelligence team at Sedex.

How Companies Can Use Sedex to Improve Cocoa Due Diligence

- Risk Assessment: Sedex enables organisations to understand cocoa supply chain risk through country, commodity, and sector-level insights, supporting stronger responsible cocoa sourcing, alignment with deforestation regulation, and broader human rights due diligence requirements.

- SAQ Analysis: The Sedex SAQ provides early-warning indicators on labour, child labour in cocoa, health and safety, and environmental practices, helping companies identify emerging risks and strengthen cocoa sustainability strategies.

- SMETA Audits: SMETA cocoa audits offer deep-dive, third-party-verified assessments that reveal non-compliances and assess supplier performance, forming a robust foundation for cocoa due diligence and ethical cocoa sourcing.

- Data Analytics: Sedex dashboards allow businesses to compare suppliers, spot patterns, and monitor progress over time, enhancing supply chain transparency in cocoa and supporting evidence-based decisions.

- Collaboration: Sedex facilitates multi-stakeholder engagement, supplier capacity-building, and shared audit approaches, helping companies advance their responsible cocoa sourcing strategies and pave the way for sector-wide improvements.

Sedex’s aim is to empower companies to take evidence-based action, not simply engage in box-ticking.

The Opportunity: Building a More Resilient Cocoa Future

Strengthening responsible cocoa sourcing presents a major opportunity for companies navigating persistent cocoa supply chain risk such as low farmer income, child labour, deforestation, and limited traceability in countries with weaker infrastructure.

Better data and stronger supplier practices directly support cocoa sustainability, helping businesses respond to threats such as climate change, swollen shoot disease, illegal mining, and volatile prices. At the same time, evolving consumer demand for single-origin chocolate, bean-to-bar transparency, healthier ingredients, and low-waste products increases the value of credible ethical cocoa sourcing.

Companies that act early gain a competitive advantage, reduce legal and financial exposure, and are better placed to make informed investments in farmer livelihoods and environmental protection as global cocoa production and market dynamics shift.

Speak to our team to see how the Sedex platform can help you assess risk, engage suppliers, and build a more sustainable cocoa supply chain – from farm to finished product.