Hidden Risks in Food and Beverage Supply Chains — and How to Manage Them

The global food and beverage industry feeds billions of people, yet behind every product lies a complex network of farms, processors, manufacturers and distributors. These supply chains are long, multi-tiered and often lack transparency – making them vulnerable to hidden environmental, social and ethical risks.

For sustainability, ESG and procurement professionals, identifying and managing these risks is no longer optional. It’s essential for compliance, brand trust, and long-term resilience. In this article, we’ll delve into the challenges food and beverage supply chains are facing, risks to watch out for, and how to manage them – using Sedex’s data and tools to provide real-world insights.

The challenge: Why food and beverage supply chains are high risk

Food and beverage supply chains are among the most complex and globally dispersed of any industry. Their deep reliance on agricultural commodities, seasonal labour, and multiple processing stages creates heightened exposure to human rights and environmental risks – from farm to factory to retailer.

Let’s take a closer look at what makes them high risk:

Multiple tiers and regions, with limited visibility. The sector depends on vast networks of smallholder farms and intermediaries, many operating in regions with weak labour and environmental governance.

Limited visibility beyond Tier 1 suppliers often leaves companies unaware of conditions deeper in the chain. Many Food and beverage businesses often only have verified information from their direct suppliers, leaving blind spots in deeper tiers. Manual data collection and inconsistent reporting make it difficult to track sustainability performance or verify ESG claims.

SMETA audits across the food and beverage supply chain show sustainability risk is 14% higher in agricultural, horticultural and fishing sites (‘primary production’) than in manufacturing sites.

This highlights the need for deeper visibility beyond Tier 1 suppliers and more comprehensive due diligence.

Seasonal and migrant labour. Agriculture and food processing rely heavily on temporary and migrant workers. Without strong oversight, these workers can face poor living conditions, long hours or even forced labour.

24% of all migrant workers across Sedex member sites work in the Food and Beverage sector (this refers to Food and beverage primary production and manufacturing sites).

Environmental pressures. Deforestation, soil degradation, water scarcity and agricultural waste are common issues. Climate change intensifies these pressures, threatening both communities and supply continuity.

Commodity risk. Certain commodities consistently appear as risk “hot spots”. Cocoa in West Africa remains associated with forced and child labour, palm oil in Southeast Asia drives deforestation, seafood supply chains in Asia and Latin America face forced labour allegations, and coffee producers often struggle with low wages and gender inequality.

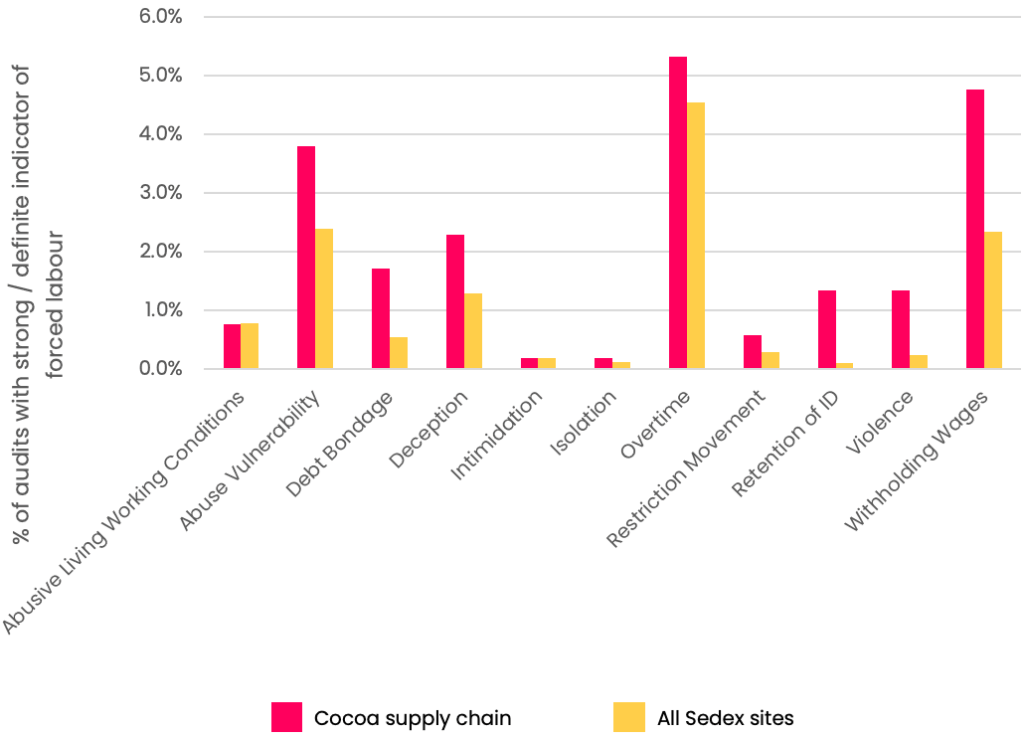

Forced labour remains a significant risk in the cocoa industry. The graph below highlights the higher prevalence of forced labour indicators in the cocoa supply chain, compared to all Sedex sites (based on SMETA audits in the last 12 months).

This highlights the need for tailored risk assessment approaches to uncover commodity-specific risks.

Regulatory and reputational pressures. Governments are tightening rules around corporate accountability. Legislation such as the EU Corporate Sustainability Due Diligence Directive (CSDDD), Germany’s Supply Chain Act, and the UK Modern Slavery Act require companies to map and monitor supplier risks. Non-compliance can bring not just legal exposure, but lasting damage to brand reputation.

The risks: What companies must watch for

Food and beverage supply chains face a range of sustainability risks. Knowing which ones are most relevant, and where they occur, is the foundation of effective risk management.

Labour standards

Labour risks remain prevalent in food supply chains. Forced, bonded or child labour can occur in agricultural production, especially in commodities with informal labour systems. Processing and manufacturing stages may bring further challenges, such as unpaid overtime, limited worker representation, or inadequate health and safety measures.

23% of all SMETA audits conducted in the last 12 months were within the food and beverage sector. Of these audits, 70% had non-compliances linked to health & safety, 34% linked to working hours, and 28% linked to wages.

Environmental impacts

Despite the higher proportion of findings from SMETA audits linked to labour standards, the environmental footprint of the food and beverage sector is vast – from farm-level emissions to packaging waste. Unsustainable land use, water pollution from fertilisers, and over-extraction threaten biodiversity and local communities.

Companies are increasingly expected to measure, report and reduce these impacts as part of their ESG commitments, and to meet stakeholder expectations, including customers and investors.

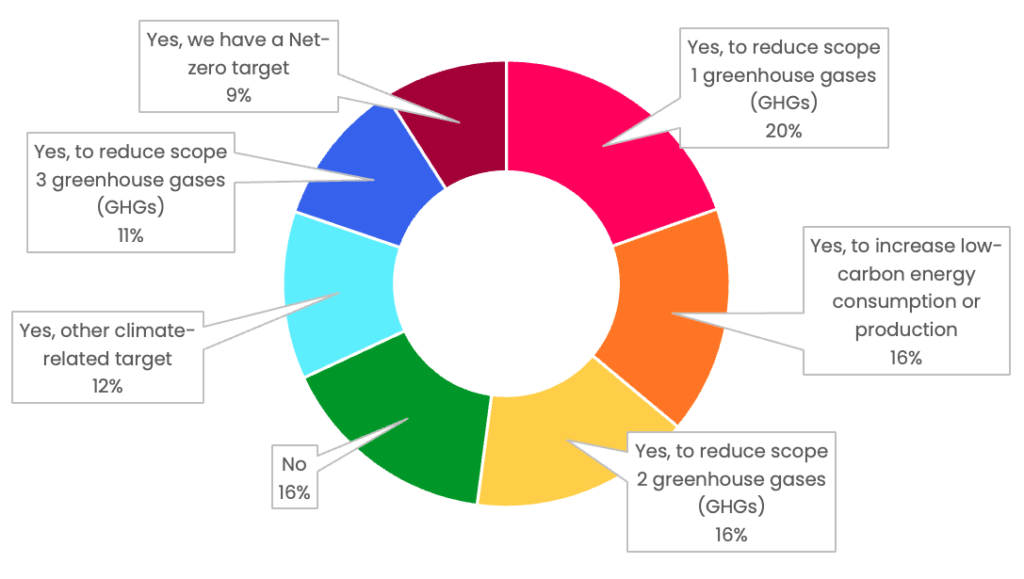

From Sedex SAQ data, about 16% of food and beverage sites report having no climate-related targets in place, while the majority are taking action – most commonly to reduce Scope 1 and 2 emissions or increase low-carbon energy use.

A smaller proportion have Scope 3 or net-zero targets, reflecting the ongoing challenge of addressing indirect emissions across complex supply chains.

Business ethics and governance

Weak governance can enable corruption, informal labour arrangements or poor oversight of subcontractors. In regions where inspections are limited, bribery and falsified records may also mask compliance issues – making embedding ethical business conduct into procurement and monitoring processes essential.

8% of audits conducted at food and beverage sites (primary production and manufacturing) had findings linked to business ethics, of which 22% were based in the US.

Highlighting the importance of auditing across multiple tiers and regions, with risks not being limited to specific contexts.

The opportunity: Turning risk into resilience

Managing sustainability risks is not just about compliance: it’s a strategic advantage. Transparent, ethical supply chains strengthen trust among consumers, investors and regulators alike.

Build brand trust. Consumers increasingly choose brands that demonstrate responsibility. Visible progress on responsible sourcing builds loyalty and credibility.

Meet investor and regulatory expectations. Reliable, verified ESG data is critical for meeting disclosure requirements and maintaining investor confidence.

Improve efficiency and resilience. Understanding where potential or actual risks lie allows companies to prevent disruptions, reduce waste and improve long-term supply stability. Responsible sourcing is not a cost, but an investment in business continuity.

The solution: How data and collaboration reduce risk

Solving these challenges requires credible data and genuine collaboration across the value chain. Sedex provides the insight and structure businesses need to identify, assess and address sustainability risks at scale.

Integrated risk assessment

The Sedex Pre-assessment Tool combines global datasets on country, sector and issue-level risks to highlight where potential problems may occur. This enables businesses to prioritise high-risk suppliers and allocate resources efficiently.

Across the past five years, Sedex risk assessments – based on data from Sedex’s Pre-Assessment Tool – have flagged over 13,500 high-risk supplier sites in the food and beverage sector.

Verified audits and self-assessment data

Sedex’s SMETA audits provide verified, independent insights into labour conditions, health and safety, and business ethics. These complement the Self-Assessment Questionnaire (SAQ), which captures suppliers’ own data to build a detailed risk profile.

When a supplier completes an SAQ or audit, the combination of self-reported data and verified audits creates a layered approach – going from broad visibility using SAQs to on-site depth and verification through audits.

On average, Sedex sites at the primary production level show lower risk levels once they complete an SAQ or audit, compared to their initial Pre-Assessment Tool score.

This demonstrates how greater visibility into a company’s practices can reduce perceived risk and enable more nuanced risk assessments.

Data-driven insights and analytics

Sedex’s analytics dashboards help companies visualise performance, identify recurring issues and track progress over time. Aggregating audit and SAQ data across suppliers enables broader analysis of trends and transparency in ESG reporting.

Collaboration for continuous improvement

Beyond traditional monitoring, Sedex’s new Collaborative Actions Required (CAR) finding type enables proactive joint problem-solving. When a non-compliance is identified, buyers and suppliers can work together directly within the Sedex platform to agree on root causes, define corrective and preventive actions, and track progress collaboratively.

In the past 12 months, the most common Collaborative Action Required (CAR) identified in the food and beverage sector were linked to the required collaboration between buyers and suppliers to remediate cases involving dismissed underage workers.

This shared responsibility approach encourages transparency, builds mutual accountability, and drives lasting improvements – moving beyond one-off audits toward continuous, cooperative progress.

Key takeaways: Assess. Act. Improve.

· Food and beverage supply chains are inherently high-risk due to complex structures, labour intensity and environmental pressures.

· Data, transparency and collaboration are key to identifying and mitigating sustainability risks.

· Sedex empowers companies to assess risks, act on findings, and continuously improve responsible sourcing performance.

Ready to strengthen your supply chain?

Get in touch with our team to discover how Sedex can help you identify, manage, and reduce sustainability risks across your global operations.