How Global Businesses Can Get Ready for APAC’s Sustainability Reporting Standards

The shift is real—and fast

Sustainability regulation across Asia-Pacific is entering a new phase. What began as voluntary guidance is turning into enforceable law. Governments are tightening rules on sustainability disclosures and human rights due diligence.

For procurement, compliance and sustainability teams in global enterprises, the changes are significant. The visibility gap below tier one—the spreadsheets, surveys and guesswork—will no longer hold up under regulatory scrutiny. Visibility and traceability are becoming legal and commercial necessities.

Why this matters for enterprise supply chains

APAC sits at the heart of most global sourcing networks. As regulation spreads, multinational buyers will face cascading requests for supplier data, emissions evidence and due diligence documentation.

Procurement and sustainability leaders can’t wait for clarity. The companies that treat compliance as the floor—not the ceiling—will protect their brands, win trust with customers and regulators, and create more resilient supplier relationships.

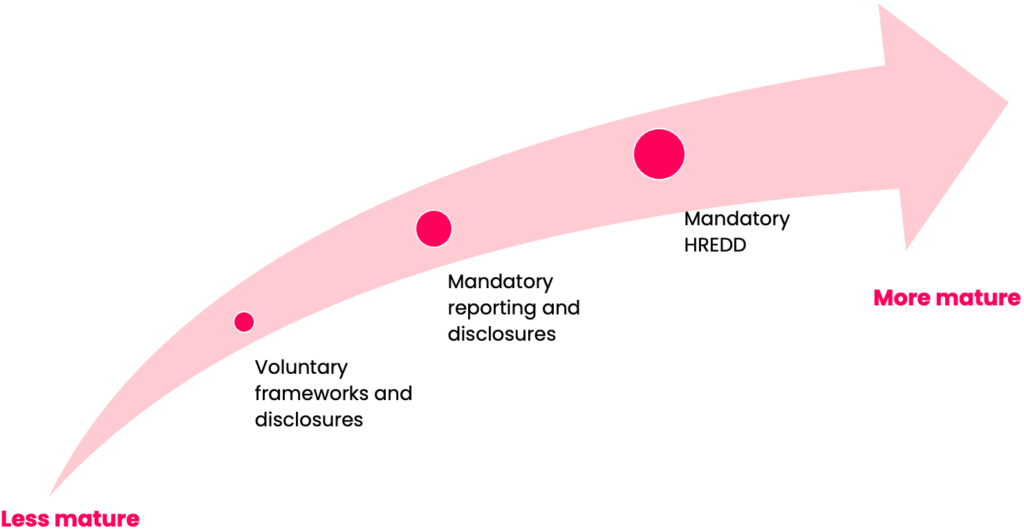

The three-stage maturity curve of sustainability regulation

| Stage | Focus | Example |

| Voluntary frameworks | Commitments and guidance | UN Guiding Principles, GRI Standards |

| Mandatory reporting | Disclosure of ESG risks, metrics and opportunities | ISSB, India’s BRSR |

| Mandatory due diligence | Managing and mitigating risks in operations and supply chains | Korea’s draft Corporate Human Rights and Environmental Due Diligence Act |

Europe moved early. APAC is now catching up—quickly, and with a more finance-driven approach.

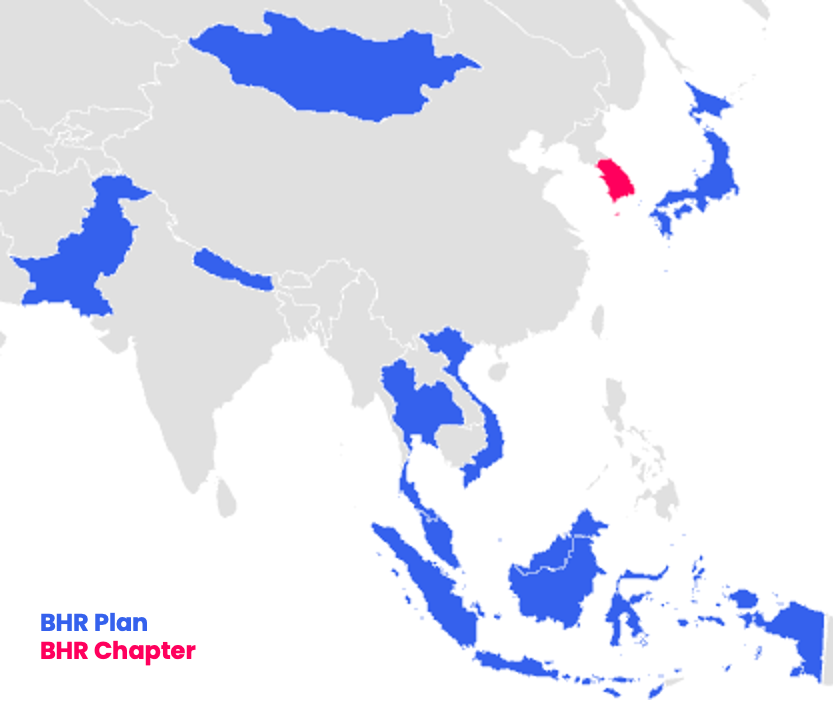

Voluntary frameworks: the foundation

Nine APAC countries now have National Action Plans on Business and Human Rights or chapters on Business and Human Rights as part of their Human Rights National Action Plan, such as South Korea, translating UN principles into state-level policy. Early movers include Thailand, South Korea and Japan, with Malaysia joining in 2025. These frameworks lay the groundwork for more prescriptive rules on business conduct and human rights.

ISSB: the new baseline for disclosure

The International Sustainability Standards Board (ISSB) has become the global reference point for sustainability reporting. Its first two standards: S1 (General) and S2 (Climate), set a consistent structure for disclosures focused on financial materiality and investor needs.

Key facts from the region:

- Australia, Hong Kong, Malaysia, Sri Lanka, Pakistan and Singapore will issue their first ISSB-aligned reports in 2026.

- Indonesia, Japan, mainland China, the Philippines, Thailand and South Korea are close behind.

- Most regulators are prioritising climate (S2) first, with assurance phased in gradually.

- Mainland China is the notable exception, signalling double materiality, similar to the EU’s CSRD.

For procurement, this means supplier climate and social data will face the same financial-grade scrutiny as audited accounts.

India’s BRSR: parallel momentum

India’s Business Responsibility and Sustainability Report (BRSR) applies to the top 1,000 listed companies. It spans nine principles—covering governance, human rights, employee wellbeing and environmental impact—and includes a “BRSR Core” with key assured metrics.

Recent updates (2024):

- Assurance can now be “reasonable assurance or assessment,” with implementation deferred by one year to FY 2024–25.

- Value-chain disclosure thresholds have shifted from 75 % to 2 % of purchases and sales, phased in to FY 2025–26, with full assurance by FY 2026–27.

These refinements reflect a balanced approach: improving data quality while recognising the realities of supply-chain implementation. And parallel lines can be drawn between this and the EU’s Omnibus proposal, delaying timelines and simplifying requirements.

The next phase: from reporting to action

Several APAC governments are drafting due diligence laws aligned with OECD guidance.

Examples include:

- South Korea: Corporate Human Rights and Environmental Due Diligence Act (re-introduced 2025)

- Thailand: Act on the Promotion of Business Conduct

- Indonesia: Targeting 2028 for human rights due diligence

Forced-labour legislation is also rising through trade agreements, linking market access to due diligence performance.

How these rules will reshape business operations

| For businesses in scope | For suppliers |

| Data management becomes strategic | Expect higher data and traceability demands |

| Comprehensive, documented due diligence | Cascading due diligence requirements |

| Cross-departmental coordination | Additional contractual obligations |

| Collaborative supplier relationships | Greater expectations for transparency and improvement |

Procurement and sustainability leaders will sit at the centre of this shift—bridging risk, legal and operational teams.

Where Sedex fits

Sedex helps companies turn fragmented supplier data into credible, shareable insight.

- One connected platform to map suppliers, collect assessments and track corrective actions.

- SMETA, the world’s most recognised social audit methodology, delivering verified, third-party data on working conditions and business ethics.

- Standardisation that scales, reducing audit fatigue and duplicated requests.

- Action tracking and improvement visibility, creating defensible due-diligence evidence for regulators and stakeholders.

“The region isn’t copying Europe – it’s building a pragmatic, finance-led approach rooted in local context.”

Turning compliance into confidence

Momentum across APAC is uneven but accelerating. Frameworks are tailored to local realities yet aligned with global expectations. The direction is clear: from voluntary to mandatory, from disclosure to accountability.

Companies that act now will save time later – when regulators, investors and customers start asking for proof.

Next step

Map your APAC supplier network and visibility gaps with Sedex.

Our team can help you design a standardised due-diligence plan that meets the region’s evolving rules and delivers credible evidence across your global supply chain.